Declining USD Amid Weaker Knowledge

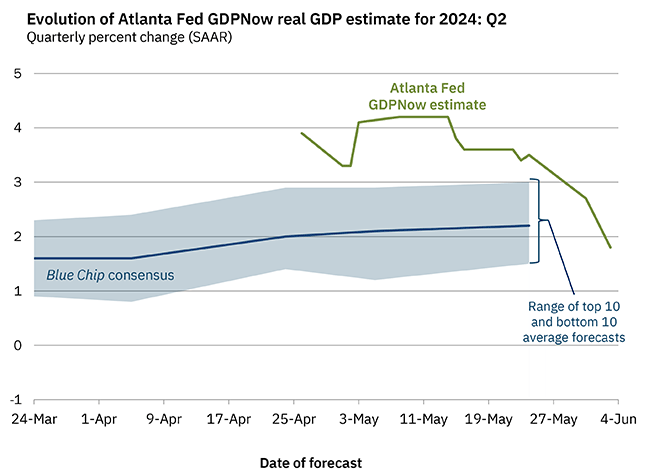

Financial information for the US reveals a notable decline. Financial development is slowing, as indicated by the Atlanta Fed’s GDPNow forecast, which dropped from over 4% to a mere 1.8% for Q2. This follows a disappointing Q1 development of 1.6%, far under the anticipated 2.5%.

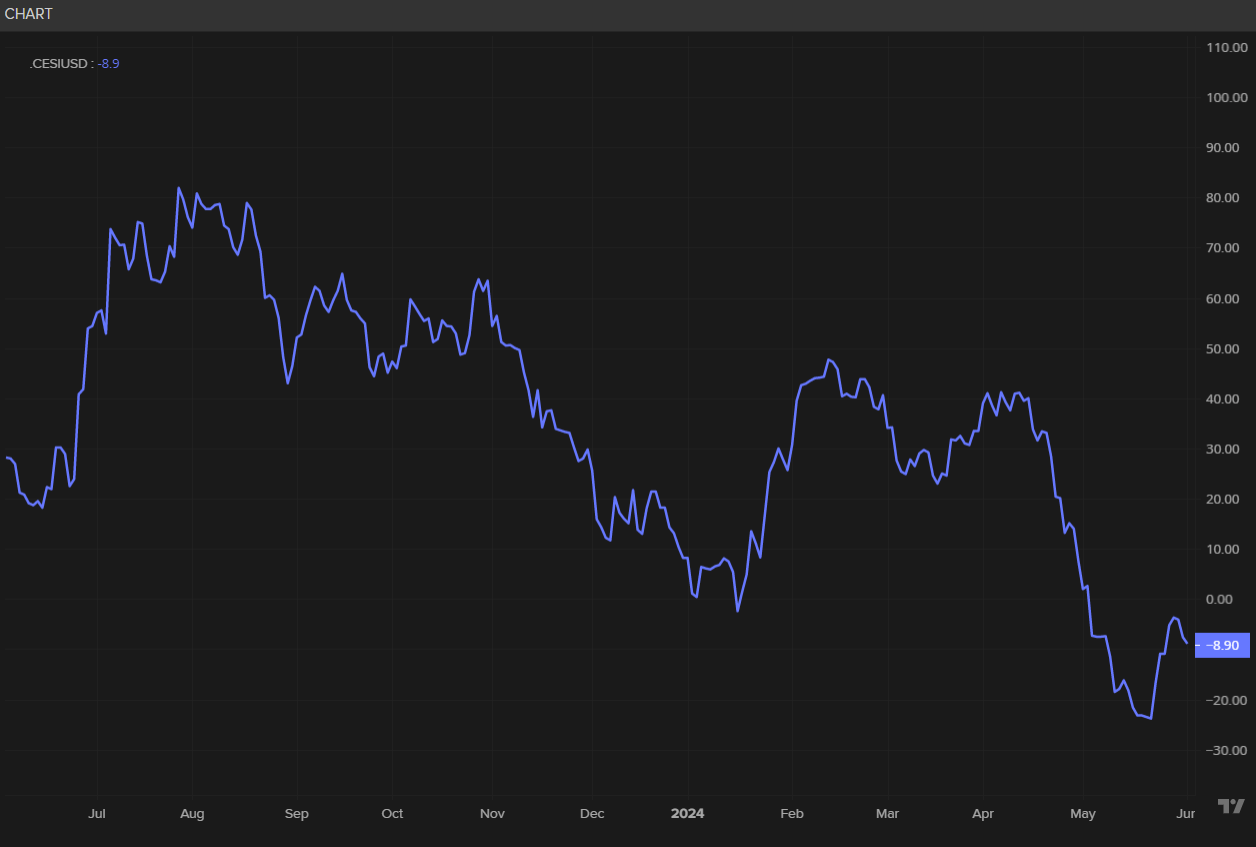

Moreover, April’s CPI and PCE inflation information recommend the disinflation development is returning, offering some aid for the Fed because it plans the timing for decreasing rates of interest. Latest information, together with the ISM manufacturing PMI survey, signifies weaker-than-expected outcomes. The US financial shock index has additionally continued its downward development.

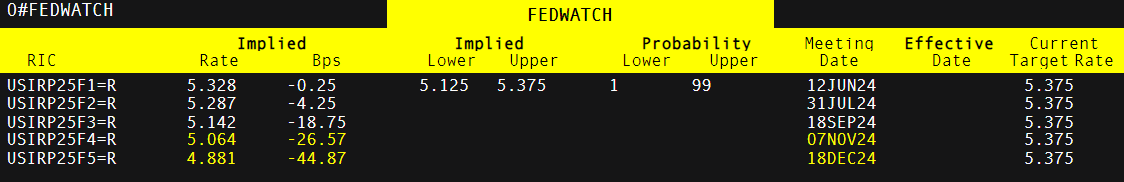

Markets predict no less than one price lower this yr, presumably two. Nevertheless, the timing is unsure because of the upcoming elections, making September and December the most definitely months for price changes.

EUR/USD Eyes ECB Price Resolution

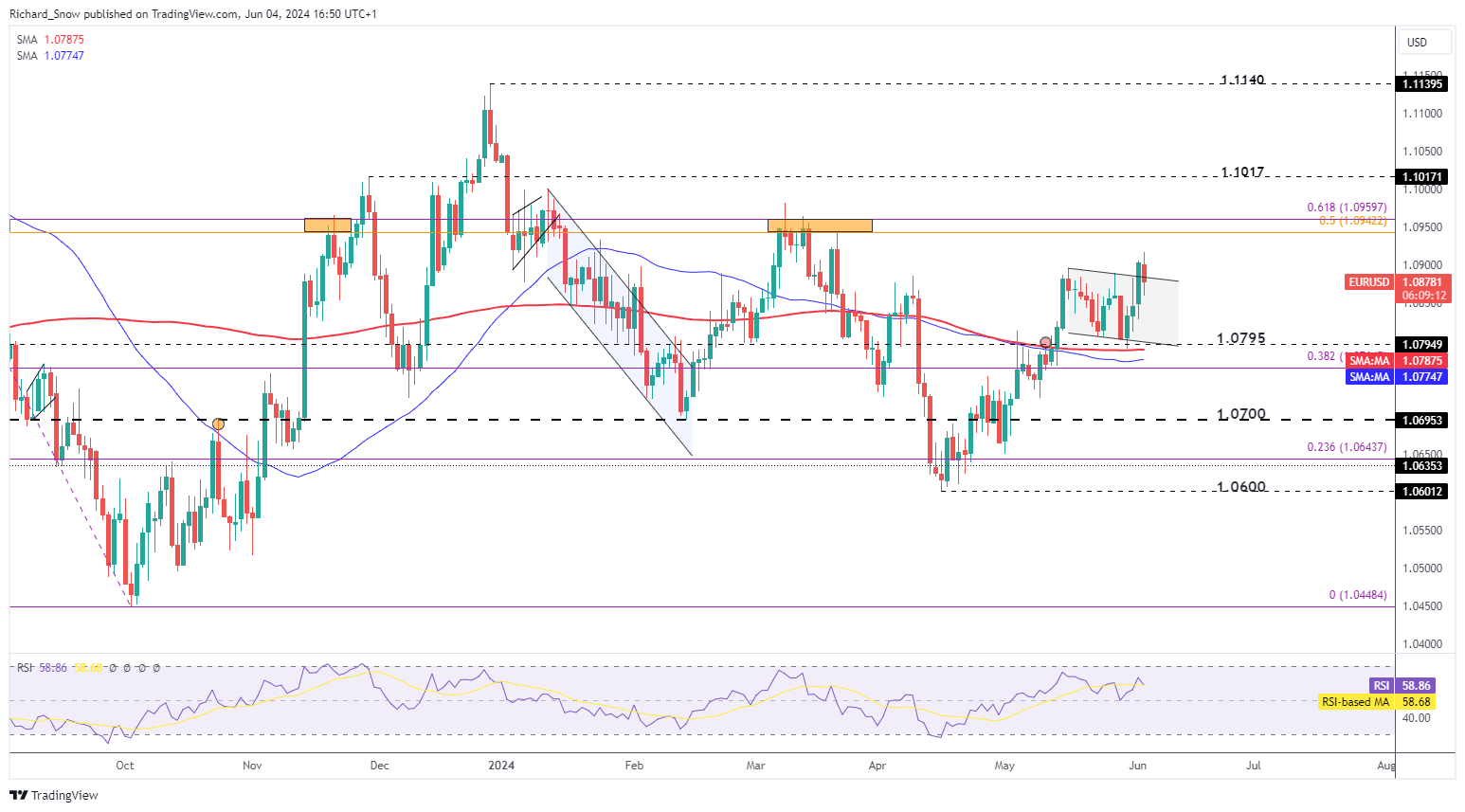

The ECB is making ready for its first price lower after a interval of speedy price hikes. Market reactions could be muted, as many officers have already pointed to June as a possible date for price reductions. The main target will likely be on the long run path of price cuts, although the ECB has communicated a cautious strategy, avoiding the expectation of successive cuts.

EUR/USD has been making an attempt a bullish breakout, supported by softer US information. For a sustained transfer increased, US information must weaken additional. A hawkish ECB lower might enhance EUR/USD, although this can be a difficult technique. Draw back dangers for EUR/USD embody a possible return to 1.0800 and channel assist.

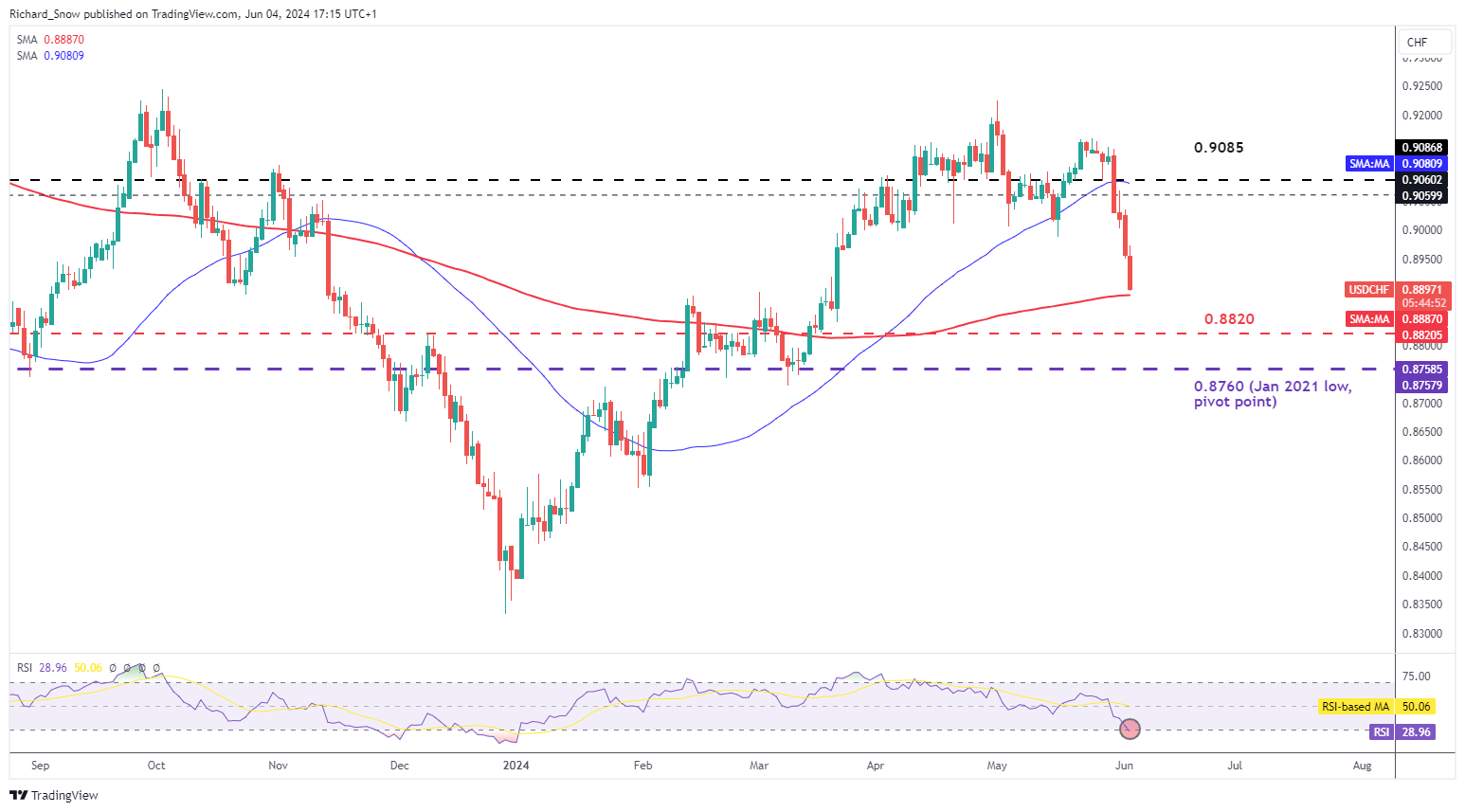

Swiss Franc Features Regardless of Overheating Alerts

USD/CHF has seen vital declines, with the 200-day easy transferring common (SMA) and the RSI indicating oversold situations. The Swiss franc has strengthened after feedback from Swiss Nationwide Financial institution Chairman Thomas Jordan, who warned of the dangers posed by a weaker franc to inflation. The SNB had already lower charges in March, resulting in a depreciation in opposition to G7 currencies.

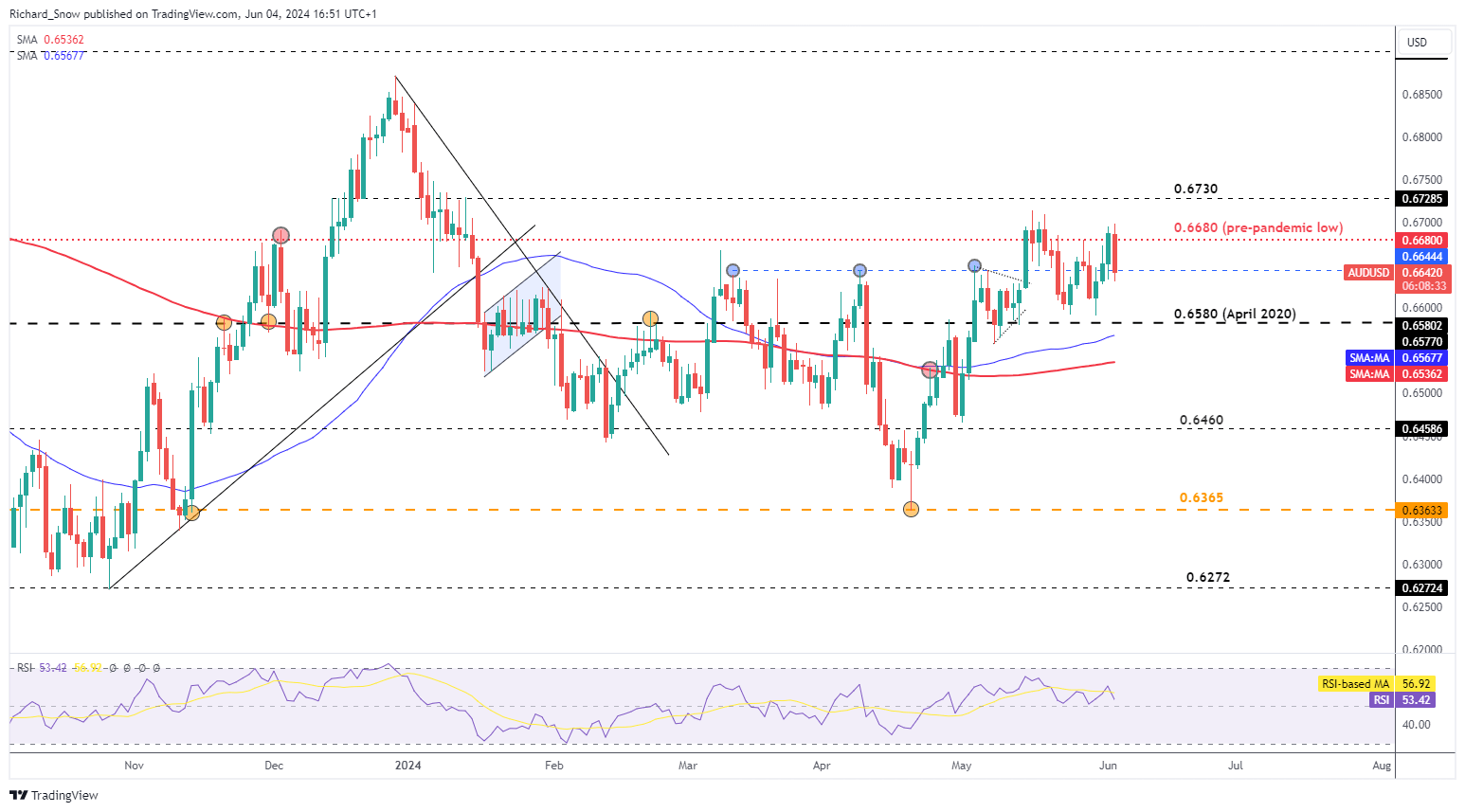

USD Bulls Goal Decrease AUD/USD Amid Weak Threat Urge for food

In a stronger USD situation, AUD/USD is price watching. The Australian greenback may lose momentum as danger urge for food declines. The forex typically correlates with the S&P 500, which has began the week decrease. This could be because of a cautious market forward of Friday’s NFP information.

Metals, together with gold, silver, copper, and iron ore, have seen declining costs. Iron ore, Australia’s principal export to China, is dealing with lowered demand from the financial big. AUD/USD didn’t retest its latest excessive of 0.6714 and has since eased decrease, with key ranges at 0.6644 and 0.6580 in focus.

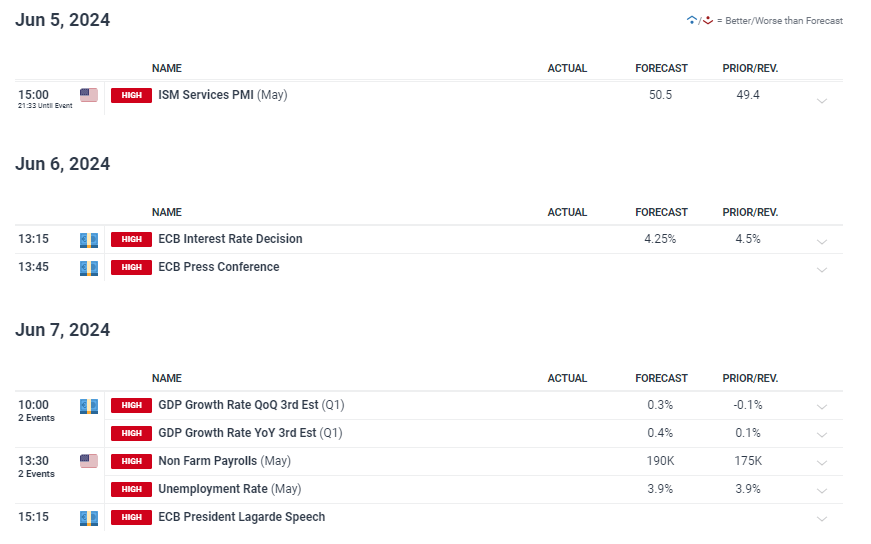

Key Upcoming Occasions

Upcoming US providers PMI information will likely be essential, with the ECB’s price lower announcement on Thursday and the US NFP and common hourly earnings information on Friday being the primary highlights.

The put up USD Value Motion: EUR/USD, AUD/USD, USD/CHF Key Ranges appeared first on Dumb Little Man.