Credit score: Screenshot courtesy of Meredith Dietz.

Time is ticking to file your taxes earlier than April 15, 2025. In case you’ve already accomplish that, congrats! Now you possibly can relax and await that refund, proper? Certain—however your aid might be short-lived. As soon as tax season rolls round subsequent yr, you may once more end up frantically trying to find receipts, statements, and different documentation wanted to file an correct return.

As an alternative of accepting the annual scramble, you may get forward of the sport by utilizing a spreadsheet to trace all of your tax-related data all year long. And there is no higher time to start out than proper now—when your tax information is recent as will be—to make your spreadsheet and begin logging issues away for subsequent April.

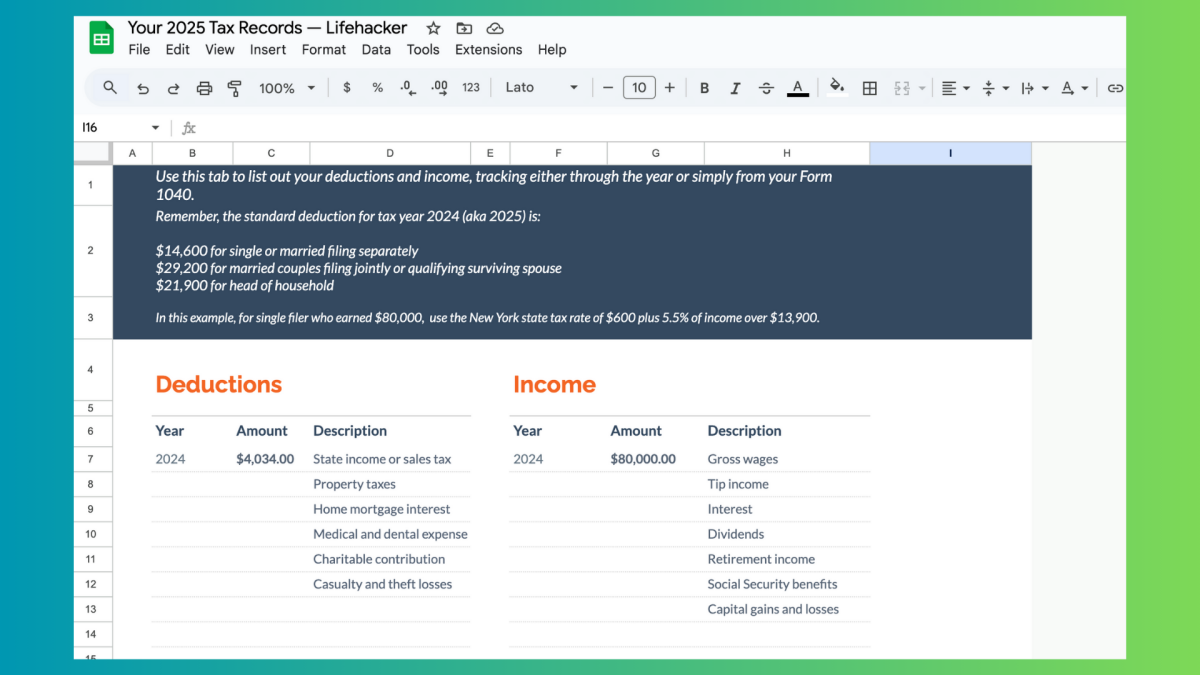

Make your personal spreadsheet—or obtain this template

I’ve created a fundamental template to get you began right here. And I imply fundamental—that is for individuals who basically simply need to convert their Type 1040s right into a spreadsheet, so all of your yearly information is one accessible, editable location. I’ve included totally different tabs relying on what you need to monitor and simply how completely you need to monitor it.

For example, the primary tab is an easy desk that turns totally different strains in your Type 1040 into rows of information—making the knowledge simply accessible from yr to yr. One other tab means that you can clearly record out your revenue and deductions all year long. I’ve even included a tab devoted to residence workplace bills, if that applies to you.

There is likely to be some redundancies or obtrusive omissions based mostly in your private scenario, so I urge you to take what I’ve given you and run wild with it. It is totally different strokes for various people, and totally different spreadsheets for various…freaks. (It is a slant rhyme.)

Fundamentals to incorporate in your tax spreadsheet

You’ll be able to increase on the template above, or begin from scratch—no matter means that you can get probably the most out this technique. Give it a transparent title like “2025 Tax Data” so you possibly can simply reference it later. Bear in mind, the aim is to have a single file the place you possibly can enter and replace data and hold all the things centralized.

To get began with a barebones tax monitoring spreadsheet, create separate sections or tabs for various classes of tax data. At minimal, you may need sections for:

-

Revenue. It will monitor revenue from jobs, self-employment, investments, retirement distributions, and so on.

-

Deductions. Checklist out something you propose to itemize or declare as a deduction, akin to mortgage curiosity, charitable giving, medical bills, and so on.

-

Tax credit. Monitor estimated bills that will qualify for a tax credit score, like training prices, childcare, and so on.

-

Prior yr tax paperwork. Hold a report of final yr’s tax return particulars and any carryover gadgets.

How you can use your tax spreadsheet

Inside every part, create rows and columns to trace the small print you want for tax time. For instance, beneath Revenue it’s your decision columns for:

-

Date earned

-

Revenue supply/employer

-

Quantity earned

-

Tax withholdings

For deductions, you could have columns like:

-

Date paid

-

Expense class (medical, mortgage curiosity, charity, and so on.)

-

Quantity

Make updating your data a behavior

As you earn revenue all year long, be diligent about coming into the small print into your revenue part instantly, whereas it is all nonetheless recent. Do the identical with potential deductions as you incur these bills. You’ll be able to replace your spreadsheet weekly, month-to-month, or at any time when is handy, so long as you follow a routine.

Hold digital copies of all of your paperwork

Any time you obtain tax documentation—like W2s, 1099s, donation receipts or mortgage curiosity statements— save digital copies and fasten or hyperlink them inside your spreadsheet file. This creates a useful archive of all of your tax data in a single spot.

Utilizing a spreadsheet to meticulously monitor your tax data all year long will prevent the inevitable time and stress of getting to reconstruct all of it on the final minute. Whereas staying organized requires diligence, that small effort goes a good distance when tax season arrives. Your future self will admire having these detailed data able to go. From probably the most thorough journey plans, to excruciatingly detailed journals, to elaborate to-do lists: If in case you have a aim, that aim wants a spreadsheet.