Tax season can cut back even probably the most organized people to stressed-out procrastinators. And in the event you’re something like me, you are not precisely probably the most organized particular person within the first place. The complexity of gathering paperwork, understanding deductions, and assembly deadlines creates anxiousness that many people dread every year. However with a well-designed tax preparation guidelines, I have been in a position to flip my taxes right into a manageable (perhaps even even satisfying?) activity effectively earlier than the April 15 deadline. This is how one can, too.

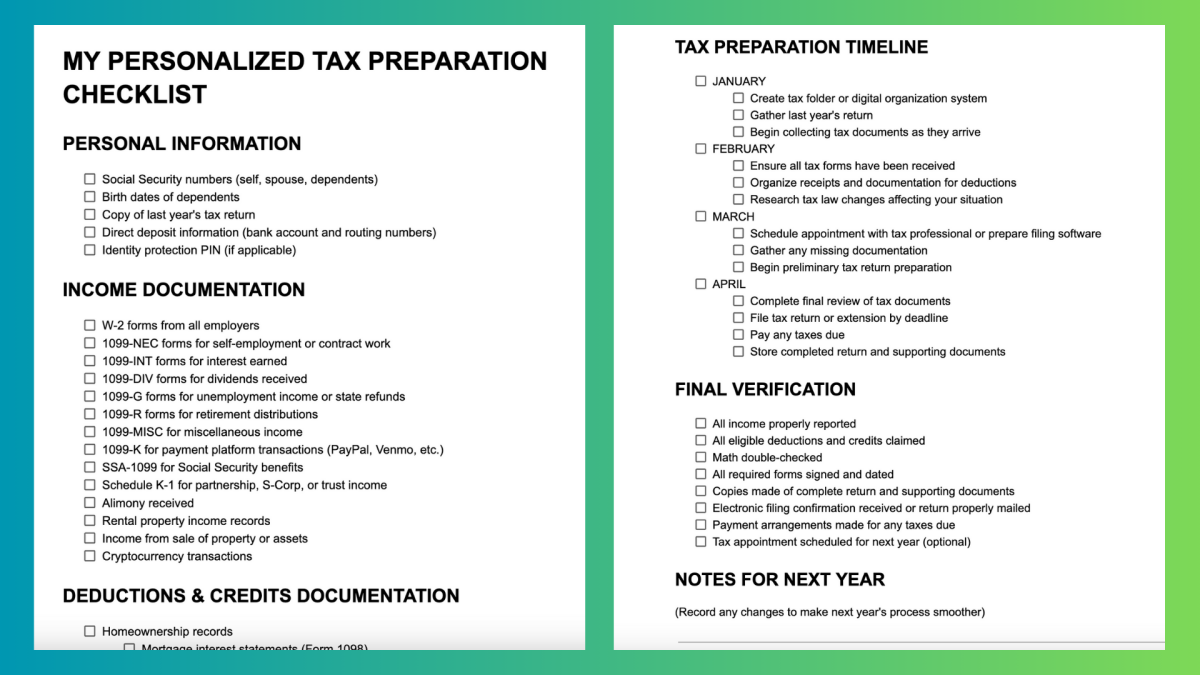

A tax preparation guidelines serves as your personalised roadmap by means of the submitting course of. Fortunately, I’ve create this template to get you began. It contains sections for private info, revenue documentation, deductions and credit, a tax preparation timeline, and a last verification check-list. All that you must do is to obtain it or make a replica in Google Docs in your personal use. This is tips on how to take advantage of this guidelines, or construct your personal from scratch.

Collect private info

Begin with the fundamentals. Your guidelines ought to embrace areas to substantiate you have got:

-

Social Safety numbers for your self, partner, and dependents

-

Delivery dates for all dependents

-

Final yr’s tax return (useful for reference)

-

Checking account and routing numbers for direct deposit

Establish your revenue sources

Checklist all potential revenue sources to make sure nothing will get missed:

-

W-2 kinds from employers

-

1099 kinds for self-employment, investments, and so on.

-

Earnings data from gig work or aspect hustles

-

Alimony obtained

-

Rental property revenue

-

Social Safety advantages

-

Unemployment compensation

Doc potential deductions

This part usually represents the most important alternative for tax financial savings:

-

Homeownership paperwork (mortgage curiosity, property taxes)

-

Instructional bills (tuition, scholar mortgage curiosity)

-

Medical bills exceeding threshold quantities

-

Charitable donations with receipts

-

Enterprise bills for self-employed people

-

Retirement contributions

-

Childcare bills

Manage by timeline

Construction your guidelines with time-based sections:

-

January: Accumulate arriving tax paperwork (W-2s, 1099s).

-

February: Manage receipts and deduction documentation.

-

March: Schedule appointment with tax skilled or put together software program.

-

April: Full last evaluation and file.

Embody verification steps

Add verification checkpoints to make sure accuracy:

-

Evaluate this yr’s return to final yr’s for consistency.

-

Double-check math and entries.

-

Confirm all Social Safety numbers.

-

Verify all required kinds are signed.

-

Make copies of the whole lot in your data.

Profiting from your tax prep guidelines

Whereas the template gives a complete place to begin, your private tax scenario might require further objects. Customise your guidelines in order that it fits your tax wants. Evaluation final yr’s return to establish recurring objects particular to your funds.

Digital vs. bodily group

Select the system that works greatest for you:

-

Digital: Use a spreadsheet, note-taking app, or devoted tax software program.

-

Bodily: Create a folder system with labeled sections for every class.

-

Hybrid: Scan bodily paperwork and arrange them in digital folders.

Start early

The largest tax preparation mistake is ready till the final minute. Start organizing as quickly as all of your paperwork first arrive, and you will keep away from the mid-April stress totally.

Evaluation and enhance yearly

After submitting, take a couple of minutes to notice what labored effectively and what did not. Add a “Notes for Subsequent Yr” part to your guidelines to recollect changes wanted for the approaching tax season.

The backside line

A customized tax preparation guidelines transforms tax submitting from a dreaded chore right into a methodical course of. By breaking down the advanced activity into manageable steps, you will not solely cut back stress, however probably establish further deductions you may in any other case miss.

Once more, here is my downloadable template for you. Be at liberty so as to add or take away objects based mostly in your monetary circumstances and submitting necessities. With this technique in place, you can strategy tax season with confidence relatively than anxiousness.