The Trump administration’s tariffs will hit American households laborious, with estimates ranging from practically $4,000 to nearly $8,000 per family. Plus, on the subject of private buying, tariffs will disproportionately have an effect on clothes and textiles, with attire costs predicted to rise 17%. And when you’re accustomed to ultra-cheap on-line buying, darkish days are forward.

Given all these rising prices, it’s extra essential than ever to maintain on high of your spending habits. Making a finances is a good begin, however following it simpler stated than executed. It’s one factor to abstractly vow to “in the reduction of on expensive espresso,” however how do you follow that when it’s 7 a.m. and also you want caffeine ASAP? Or what in case your restrictive finances causes a lot nervousness, you impulsively begin “revenge spending?” Let’s check out some methods you may change into a extra conscientious spender, particularly when costs are uncontrolled.

Determine the place your cash goes

With a view to undo unconscious spending habits—like the prices of way of life creep—it’s important to confront some powerful questions on your funds as truthfully as potential.

Crucial query to reply: The place does my cash go? Don’t accept estimates, right here. Undergo your financial institution statements and look your spending habits full within the face. Then consider which bills are literally beneficial to you, and never some subscription service you forgot about way back. It’s far simpler to eradicate unconscious spending when you carry it out into the open.

Acknowledge your spending triggers

The important thing to breaking any habits is knowing what triggers it. Possibly you are vulnerable to spending while you’re confused, bored, or celebrating. Or possibly it is merely about comfort, or social strain, or compelling advertising and marketing techniques.

Take time to mirror in your latest impulse purchases. What emotional state had been you in? Have been you influenced by others? Figuring out these patterns is essential to breaking the cycle.

Get particular about your cash objectives

The concept of “slicing again on spending” is summary and laborious to attain. It’s like saying you wish to “learn to prepare dinner” with out ever choosing out a recipe or shopping for any substances. As an alternative, you want particular, attainable objectives to information your conscientious spending.

One place to start out along with your particular spending objectives is to bodily write down the stuff you wish to purchase earlier than you purchase them. Use these financial institution statements to tell what gadgets make your official “to-buy listing.” Once you learn over gadgets on this listing, you’ll be capable to make a extra considerate choice as to what you actually want.

Create monetary friction

After I was an adolescent who wanted to cease biting her nails, I began sporting gloves. Did I look cool? Positively not. Nevertheless it labored. Make unconscious spending tougher by creating obstacles—or “monetary friction”—for your self by:

What do you suppose thus far?

-

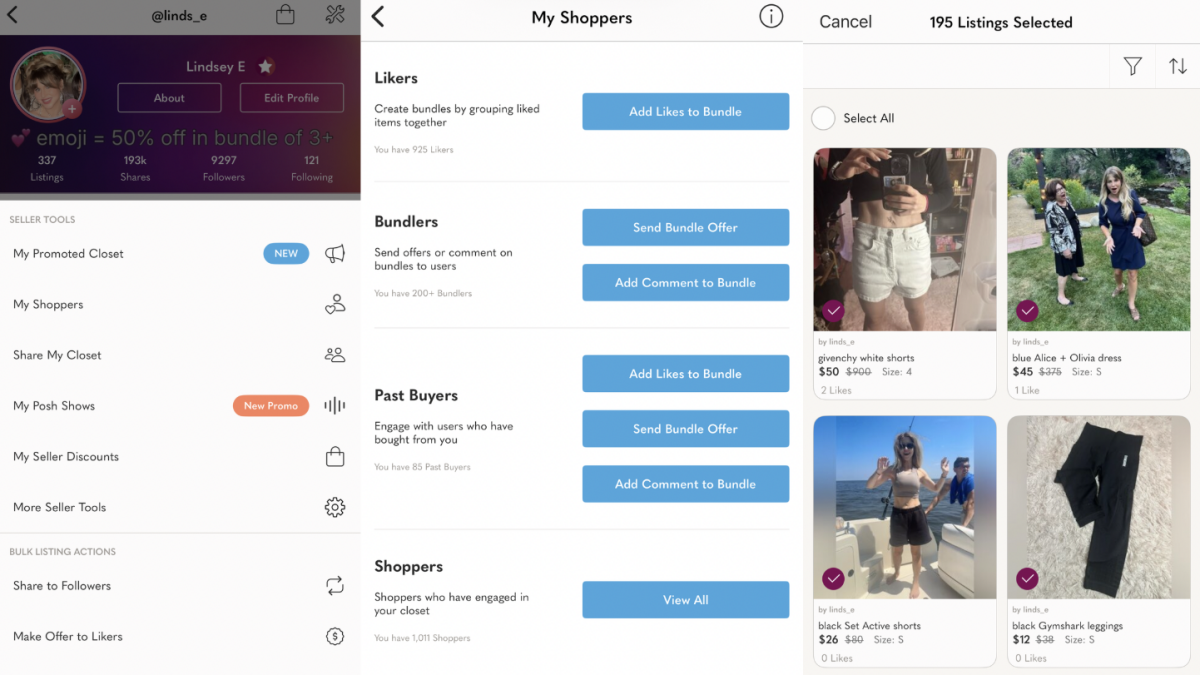

Eradicating saved fee data from web sites

-

Unsubscribing from retail emails and notifications

-

Deleting buying apps out of your telephone

-

Utilizing money for discretionary spending

-

Putting financial savings in much less accessible accounts

These obstacles appear small, however they could be a large assist in curbing unconscious spending patterns.

Implement a ready interval

One other tactic is introducing a deliberate delay between the will to buy and the act of shopping for. Earlier than making non-essential purchases, particularly on-line, institute a compulsory ready interval:

-

For gadgets beneath $50: Wait 24 hours.

-

For gadgets $50-$100: Wait three days.

-

For gadgets over $100: Wait one week.

This straightforward delay helps distinguish between needs and desires, typically breaking the spell of impulsive wishes. Consider it as a cooling-off interval.

Keep in mind, you’re nonetheless allowed to deal with your self

Chilly-turkey restriction is a recipe for an unhealthy relationship with cash. As an alternative, it’s essential to indulge thoughtfully. Ask your self, “How do I count on this buy will make me really feel? What do I need it to make me really feel? What emotions am I making an attempt to keep away from by shopping for it?” Once you really feel assured that you just’re spending solely on stuff you love and never losing cash on stuff you don’t love, you’ll make significantly better monetary selections.

Solely you may decide what is really beneficial in your life. Personally, I’ve budgeted sufficient cash for my each day espresso indulgence. For you, it would imply treating your self to a flowery dinner as soon as a month, or slicing again on restaurant prices so as to go wild on trip in just a few months. Permit your self to indulge, particularly if these indulgences enhance your overall relationship along with your cash.