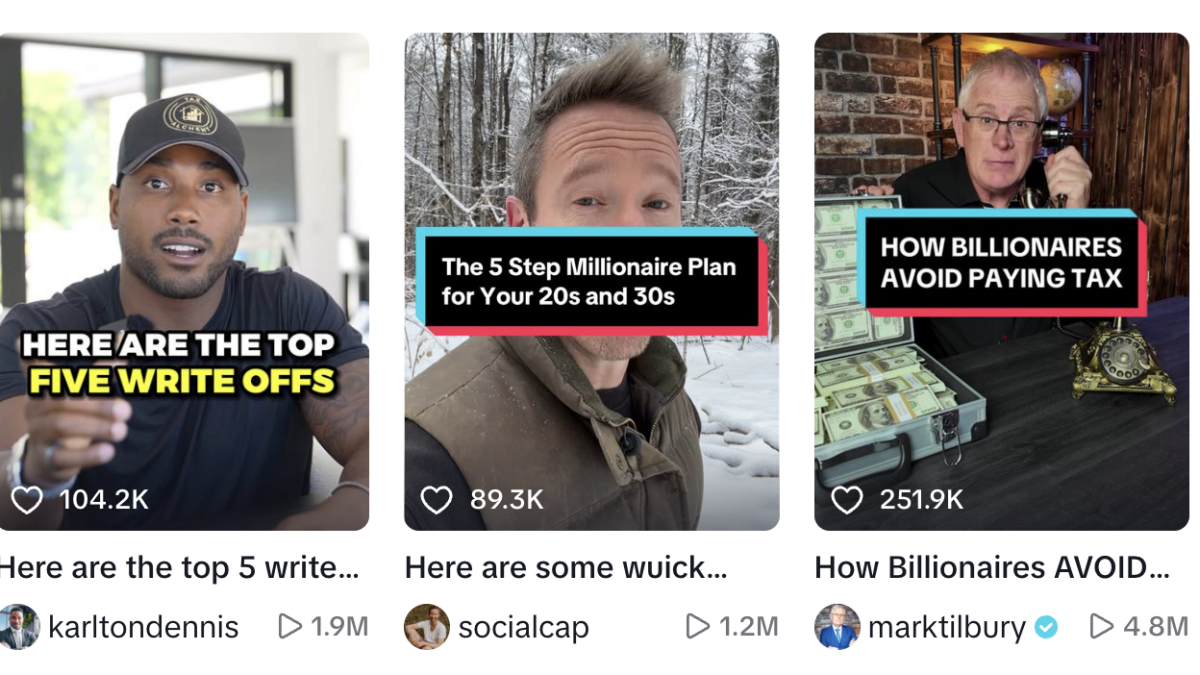

Credit score: Photographs courtesy of TikTok.

Relating to managing your funds and taxes, think about recommendation from TikTok with a hefty grain of salt. Sure tax “loopholes” might go viral, however that does not imply they’re good in your particular tax state of affairs. TikTok’s bite-sized movies have a behavior of distilling nuanced tax methods into only a few sentences—a recipe for misinformation. This recommendation is evenly deceptive at greatest, and completely inaccurate at worst. Blindly following this recommendation might price you in penalties, again taxes owed, and an amazing problem.

Let’s check out the questionable TikTok tax recommendation I’ve seen and how one can be sure it would not lead you and your cash astray.

Hiring your children

Some movies counsel that enterprise house owners ought to rent and pay their kids as staff. The declare is that this permits the kid to contribute to a Roth IRA utilizing their “earned revenue.”

Whereas it is true that solely earned revenue could be contributed to a Roth IRA, hiring your children has very particular necessities. The work they do have to be official and age-appropriate, and the pay have to be cheap for the job carried out. Merely placing your kids on payroll as a tax workaround may very well be thought of fraud.

Hiring your canine

I’ve seen movies like this one garner a whole lot of hundreds of likes for the declare that you would be able to write off your pet as a guard canine who protects your enterprise. It is true that guard canine bills are deductible if the canine is educated and of a breed match for the job. Sadly, making an attempt to deduct your corgi for often barking on the door is not going to get your very far with the IRS.

Writing off your Vary Rover

One other viral declare a few authorized “tax loophole” advises individuals to jot down off the price of a luxurious car like a Vary Rover or Mercedes-Benz G-Wagon on their taxes.

The reality is, in keeping with the IRS Part 179 tax code, companies could possibly write off a G-Wagon if it’s used for enterprise functions at the very least half of the time. Part 179 does permit companies to deduct the complete price of sure belongings like automobiles within the 12 months they’re positioned into service, fairly than depreciating the expense over a number of years. However there are very strict necessities. Moreover, there are limits on the deductible quantity for luxurious automobiles that exceed $19,800 for automobiles and $20,500 for vehicles and vans in 2023.

Forming an LLC to deduct private bills

Fortunately, this defective recommendation appears to falling out of vogue, however typically outdated movies like this one make the rounds. Creators declare you may type a restricted legal responsibility firm (LLC) to deduct private bills like your mortgage, automotive funds, and even grocery payments as enterprise bills to scale back your taxes.

Whereas LLCs can present some tax advantages, merely forming one would not magically help you write off all of your private prices. There are strict guidelines about what qualifies as a official enterprise expense. Deducting private bills improperly might land you in sizzling water with the IRS.

The underside line

Relating to advanced subjects like these (and actually all issues tax-related), do not depend on temporary movies from non-professionals. Improper tax methods might inadvertently price you way more in penalties, curiosity, and charges down the highway.

Except a TikTok video is from a credentialed tax skilled giving a common overview of tax ideas, take it with a hefty scoop of skepticism. It is best to seek the advice of a professional tax skilled who can have a look at your particular state of affairs and provide you with official, tailor-made recommendation. What makes for an excellent viral video hardly ever interprets to good tax planning.