Zelle has been round as a handy digital cost platform since 2017, however has now closed down funds inside its standalone apps for Android and iOS, because it promised it will final October—although the transfer is an indication of Zelle’s success quite than its failure, and most Zelle customers aren’t going to wish to alter something.

When you’re one of many 150 million or so individuals who make use of Zelle, you are now not going to have the ability to use the Zelle app to ship cash to associates, household, and companies. Nevertheless, Zelle lives on as a platform: It is now built-in into the operations of greater than 2,200 monetary establishments, so you will nonetheless have the ability to use it via your banking app.

The Zelle apps are not any extra as a result of Zelle has expanded its integrations so efficiently. The peer-to-peer cost system says lower than two % of transactions have been being made via these apps by the tip of final yr, so it did not make sense to maintain them going.

Nothing is altering when it comes to the hyperlinks to banks and credit score unions—if that is the way you already do your Zelle enterprise, you won’t even have seen the standalone app has been pulled. Zelle customers shifted $1 trillion in funds over the course of 2024, in order a platform it is not going wherever anytime quickly.

One more reason for the swap is safety. As Zelle’s YouTube web page is testomony to, customers of the app have been often focused by scammers—by way of courting apps, ticketing platforms, rental listings, on-line marketplaces, job boards, and so forth. Having Zelle work via banking techniques makes it safer as effectively.

How you can swap

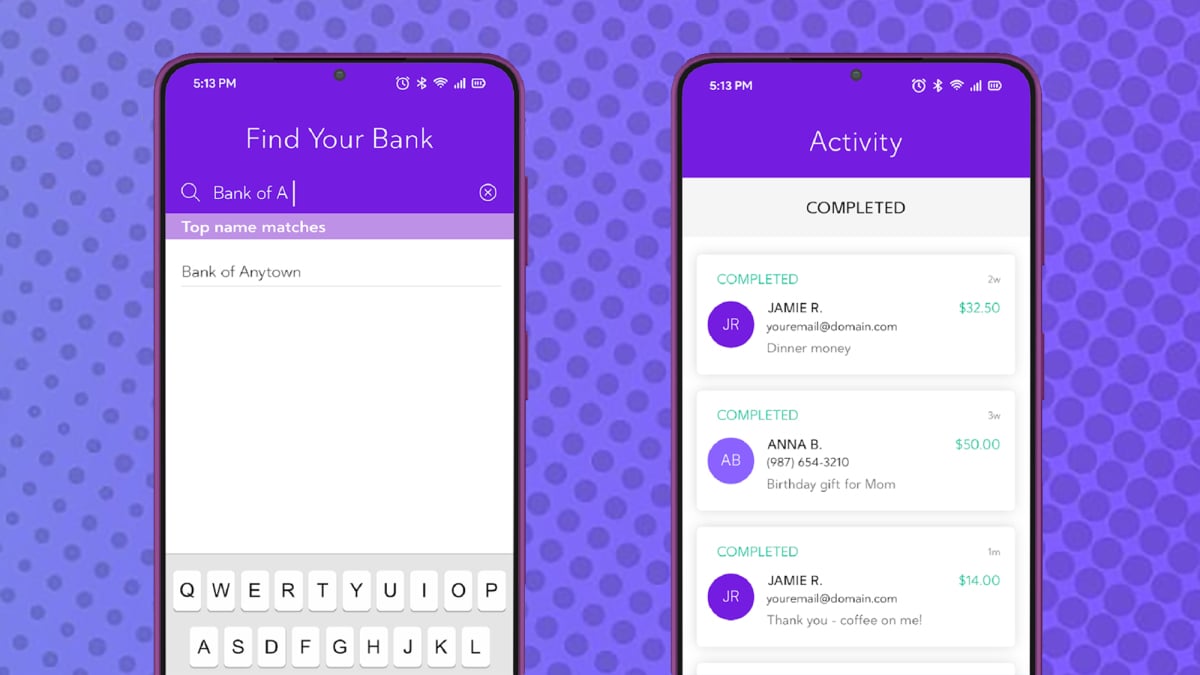

Zelle is standard for peer-to-peer funds.

Credit score: Zelle

Provided that two-percent determine talked about above, chances are high that you have already set Zelle up via your financial institution. If not, you will must register a Zelle account along with your financial institution, or swap to a monetary establishment that gives Zelle: You may search via this complete listing. Till you arrange Zelle some other place, you will not have the ability to make and obtain funds.

The specifics will in fact rely in your financial institution and its app, however when you click on via from the listing then you definitely’ll be taken to the related sign-up web page—this is the one for Wells Fargo, for instance. You should present your registered e-mail tackle or cellular quantity, and the financial institution will do the remainder (you should use the prevailing particulars already registered with Zelle).

What do you assume thus far?

If your financial institution or credit score union helps Zelle, you can too dig via the choices within the official app or the official web site, and it’s best to have the ability to register that method too: More often than not it will solely be a few steps to get Zelle arrange, and you may then register the individuals and companies you need to allow transactions with.

Sadly, your cost historical past is not going to maneuver together with you, although it is going to be obtainable within the Zelle app till August 11, 2025. Though funds are actually blocked, the app is not going to cease working solely, so you have received just a few months to notice any data you need to maintain.

There are many different cost platforms you possibly can flip to, when you do need to keep out of your banking app, together with Venmo, PayPal, Money App, Google Pockets, and Apple Pay—although they do not have fairly the identical tight bank-account integration that you just get with Zelle, and which Zelle is now targeted on.