Peer-to-peer cost apps like Venmo supply a simple strategy to ship cash to family and friends in addition to companies promoting items and companies—however that ease makes them a goal for scams involving theft and fraud.

Listed here are the commonest Venmo scams to observe for.

The mistaken cost rip-off

Should you obtain cash you were not anticipating from somebody you do not know by “accident,” it isn’t really an accident. Scammers will Venmo you, declare it was a mistake, and ask for the cash again as a brand new cost. This may occasionally appear innocent, nevertheless it sometimes entails scammers charging so-called mistaken funds to stolen bank cards then connecting their private playing cards to obtain funds in return. If the unique funds are reversed when the stolen card is reported, the cash will come from your account.

To keep away from this rip-off, do not ship a reimbursement to somebody you do not know. As a substitute, contact Venmo help to allow them to reverse the cost with out compromising your account. You must also block the consumer who despatched the cost.

The impersonation rip-off

Scammers could attempt to trick you into sending funds by impersonating somebody you understand. They might change their username or profile image to match somebody in your public feed—in case your Venmo transactions aren’t personal, cease proper now and alter that setting—so you will not suspect something is amiss. Typically, these cost requests are sudden and appear time-sensitive.

Should you obtain a cost or cost request you were not anticipating or that appears pressing, faucet the profile image to view the account and make sure their id. You must also message that individual outdoors of Venmo to make clear the request earlier than sending any cash.

The tech help rip-off

Should you attain out to a tech help line (for something, not simply Venmo), it is best to by no means ship cash through Venmo for that service. Scammers could spoof telephone numbers and impersonate technical help employees, whose assist is sort of at all times free. Venmo warns that unhealthy actors could attempt to trick you with one thing that feels like this:

“Good day, thanks for calling (main firm title) Help. Andrew right here, prepared to assist! Earlier than we get began, I might want to take your cost for our help at the moment. Do you might have a Venmo account? If not, I’d be pleased that can assist you create one!”

All the time find firm contact info instantly from their web site by typing the URL in quite than clicking by means of from search (the place outcomes might be spoofed), and by no means ship a Venmo cost for these companies.

The Venmo textual content/name rip-off

Equally, scammers could contact you through name or textual content pretending to be from Venmo’s help crew. They might let you know that there was unauthorized exercise in your account and ask you to log in through a hyperlink they ship your or to present your multi-factor authentication code. It is a phishing rip-off, as Venmo won’t ever ask for verification codes or request to entry your account remotely. You must also be skeptical of a message that asks you to put in a third-party app, ship a cost, or confirm a brand new account. By no means click on hyperlinks in unsolicited messages.

As a substitute, contact Venmo help instantly to verify any requests, and report pretend or suspicious texts and emails.

The prize rip-off

Should you obtain a textual content or e-mail saying that you’ve got gained cash from Venmo, it is a rip-off. This phishing assault features a fraudulent hyperlink to signal into your Venmo account, which palms your info on to scammers. By no means enter your Venmo login wherever besides Venmo.com or the Venmo app (which it is best to at all times navigate to instantly quite than through an unsolicited hyperlink), and don’t present anybody along with your info except you might have contacted Venmo help instantly.

The pretend donation rip-off

Donating to a trigger or group you care about is nice, however scammers make the most of this by circulating fraudulent Venmo accounts and accumulating funds within the title of different people or organizations. Earlier than you ship cash, confirm the account belongs to the group—do not merely depend on hyperlinks from social media. You must also analysis the easiest way to help and contribute to organizations instantly from their web site or social accounts.

The romance rip-off

Romance scams are an extended sport: fraudsters will create pretend social media profiles and work to develop a relationship with you, achieve your belief, and ask for cash through Venmo. This rip-off performs in your feelings, and requests are sometimes associated to bills to come back go to you or potential funding alternatives. Be cautious of people that attain out to you on-line to create an emotional connection, and by no means mortgage cash to somebody you’ve got by no means met IRL.

What do you suppose to date?

The job supply rip-off

Should you obtain an unsolicited textual content from a recruiter with a job supply, it is positively a rip-off. Typically, these gives include requests to pay upfront for onboarding or to maneuver cash round utilizing your Venmo account. Clearly, that is cash misplaced. Ignore these messages—do not reply, and do not click on hyperlinks.

An analogous rip-off is a message from a potential landlord requesting a deposit earlier than you’ve got signed a lease.

The fraudulent buy rip-off

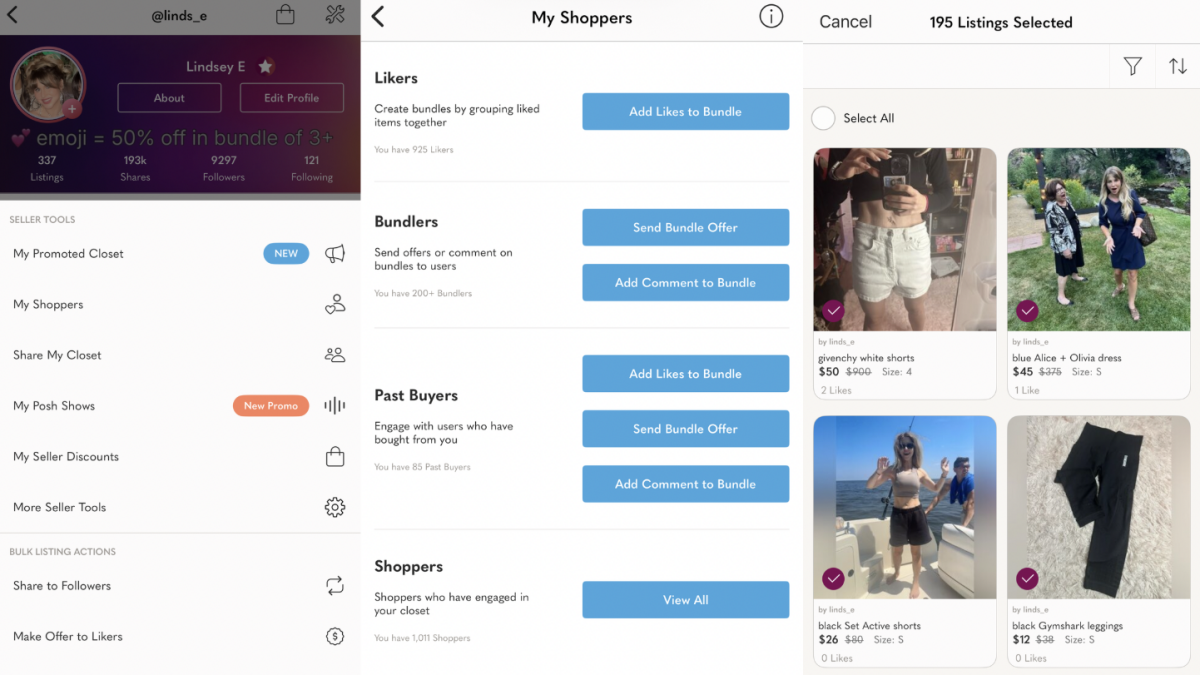

Should you’re shopping for or promoting items and companies utilizing Venmo funds, be careful for ways scammers use to steal cash. They might ask you to pay upfront after which by no means ship you the merchandise they’ve promised, or they’re going to ship you pretend delivery info. They might additionally ask you to not mark the cost as a purchase order, which makes the transaction ineligible for Venmo’s buy safety.

To keep away from this rip-off, solely purchase from Venmo authorised enterprise accounts—you may see the message “Eligible gadgets lined by Buy Safety” underneath the Pay button. Should you pay a private profile, be sure you mark it as a purchase order.

When promoting, do not ship gadgets with out receiving reputable funds, even when the client exhibits you screenshots of supposed Venmo transactions (which might be really pretend cost invoices). Scammers could “unintentionally” ship you an overpayment (utilizing a stolen card or checking account) for a purchase order and request that you simply refund the additional—like with the mistaken cost rip-off, you may finally be on the hook.

The paper examine rip-off

Scammers could ship you a paper examine and ask you to ship them a cost on Venmo. The examine could even clear whenever you deposit it however will bounce later, so that you’re out funds you’ll be able to’t get again. Do not alternate different types of cost for Venmo funds.

Too-good-to-be-true scams

Whereas these are among the most typical methods scammers use Venmo, there could also be others. For instance, be cautious of utilizing Venmo to pay for hard-to-find gadgets—like live performance tickets or uncommon collectibles—marketed on different platforms, as these might be scams that alternate cost for nothing in return. Additionally, do not pay for present card offers or investments through Venmo.

The best way to shield your self

The entire guidelines of rip-off avoidance apply to Venmo: do not click on hyperlinks in unsolicited messages or present your account info to anybody you do not know, and do not ship funds to strangers. Beware messages that deliver up feelings or sense of urgency, which may cloud your judgment within the second. If one thing sounds too good to be true, it most likely is.

Solely use Venmo to pay folks you understand and belief, and guarantee your whole transactions are personal—there is no purpose anybody must see your cost historical past. Arrange two-factor authentication on your Venmo account to forestall unauthorized logins (however know that these codes are additionally phishable). Test your monetary information, together with your credit score report and financial institution statements, often to catch potential theft and fraud rapidly.